FanTAXtic

Financial secrecy

Raymond Baker - Capitalism's Achilles Heel

Since the end of the Cold War, the opening years of the globalizing era have produced an explosion in the volume of illegitimate commercial and financial transactions. North American and European banking and investment institutions have been flooded with laundered and ill-gotten gains. Totaling trillions of dollars, most of these sums are generated through secret arrangements between cooperating but distant private-sector entities.

C. Wright Mills said:The very rich have used existing laws, they have circumvented and violated existing laws, and they have had laws created and enforced for their direct benefit.* One of those laws is the Banking Law of 1934 which makes it a criminal act for a bank to reveal the name of an account holder. Bank secrecy is a swiss invention which quickly spread throughout the globe. Financial secrecy favors criminality and in a corrupt world there is of course a need for a safe place to store criminal money. In the 1930s for example Meyer Lansky, a member of the Jewish Mafia with links to the Italian Mafia, used Swiss bank secrecy, assured by the Banking Law of 1934, to launder his criminal money. He even bought an offshore bank in Switzerland.*With the help of lawyers, accountants, white-shoe professionals and complicit Western governments, the wealthy and well-connected have avoided paying trillions of dollars in taxes.** In the world of power secrecy is linked to corruption. Niels Bohr is believed to have said:The best weapon of a dictatorship is secrecy, but the best weapon of a democracy should be the weapon of openness.* Let's see...

Tax havens

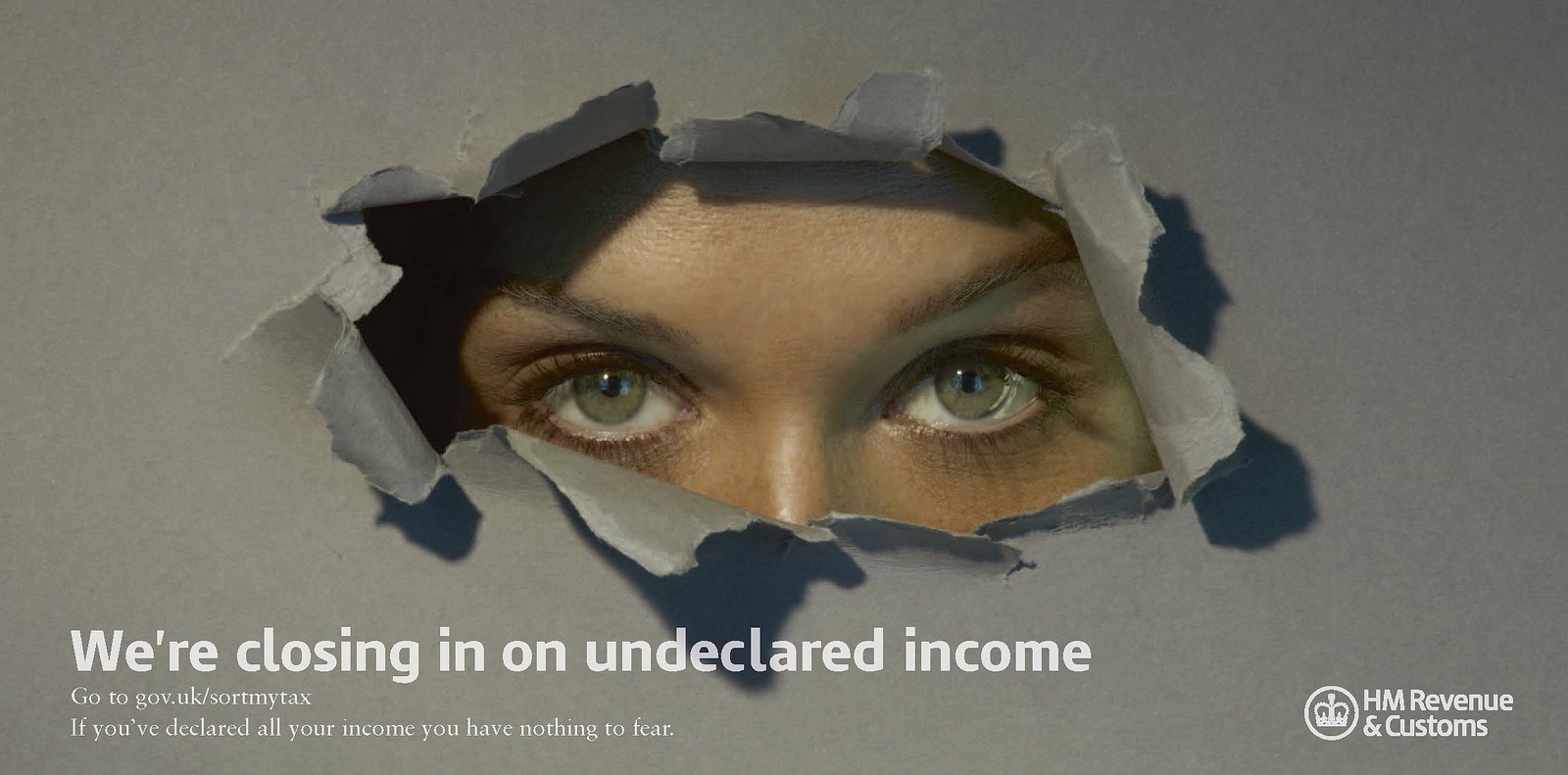

According to UK propaganda...

Northern Ireland Open Government Network - Independent Commission on Freedom of Information

Prime Minister David Cameron has championed open government in the UK with a pledge to make the government "the most open and transparent in the world".

But is this true?

screenshot

Offshore Protection - Is the UK a Tax Haven? Offshore Jurisdiction Review

While the United Kingdom itself is not traditionally classified as a tax haven, its overseas territories consistently rank among the world's leading offshore jurisdictions. British territories like the British Virgin Islands, Cayman Islands, and Bermuda top global tax haven rankings, offering minimal taxation and significant financial privacy.*

The Tax Justice Network reported that Various OECD member states run satellite secrecy jurisdictions, but Britain's network is by far the largest, accounting for between a third and a half of the global market in offshore financial services.* In 2013 The Guardian reported that Britain, in partnership with Her Majesty's overseas territories and crown dependencies, remains by far the most important part of the global offshore system of tax havens and secrecy jurisdictions.*

Dan Glazebrook - Britain is the Heart and Soul of Global Tax Evasion

The British government’s claim to be tackling tax avoidance is about as credible as Al Capone claiming to be leading the fight against organized crime. In fact, Britain is at the heart of the global tax haven network, and continues to lead the fight against its regulation.*

source

Tax haven expert Nicholas Shaxson said that the City of London Corporation isan offshore island inside Britain, a tax haven in its own right.** As opposed to what the power elite try to make you believe, the reality is that the United Kingdom with its financial capital the City of London is world leader in housing tax havens. Its overseas territories—Cayman Islands, Jersey, Bermuda, Guernsey, Anguilla, British Virgin Islands, Gibraltar, Seychelles, Isle of Man, Turks and Caicos Islands, etc—are tax havens or offshore financial centres which prove to be of good use to the super-rich. In 2013 The Guardian reported that Cameron could act to bring UK territories into line on offshore investments but he's in thrall to powerful City players.*

According to United States propaganda...

Barack Obama - Transparency and Open Government

My Administration is committed to creating an unprecedented level of openness in Government. We will work together to ensure the public trust and establish a system of transparency, public participation, and collaboration. Openness will strengthen our democracy and promote efficiency and effectiveness in Government.*

But is this true?

The reality is that the U.S. with its financial capital, the Financial District in New York, is second in housing tax havens. The political elite serve as mouthpieces for the power elite. Their mouths speak openness but they work for secrecy. Their mouths speak democracy but they act against it with globalization. Under Obama global espionage exploded and torture was practiced. Under Obama the US waged constant wars in parts of the world rich in resources or in any other way of geopolitical importance. The whole concept of war has changed under Obama*. Under Obama covert drone strikes flourished*. Obama's administration is now labeled the "most secretive presidency in American history"*. He's a professional liar and this is no secret.

FanTAXtic

Lucy Komisar - Offshore Banking: The Secret Threat to America

Why, if there’s an important role for a regulated banking system, do you allow a non-regulated banking system to continue? It’s in the interests of some of the moneyed interests to allow this to occur. It’s not an accident; it could have been shut down at any time. If you said the U.S., the UK, the major G-7 banks will not deal with offshore bank centers that don't comply with G-7 bank regulations, these banks could not exist. They only exist because they can engage in transactions with standard banks. The G-7 are the top industrialized countries.*

Tax havens exist because the governments allow them to exist. While the power elite make sure the common taxpayers are taxed, they also make sure the super-rich are not.